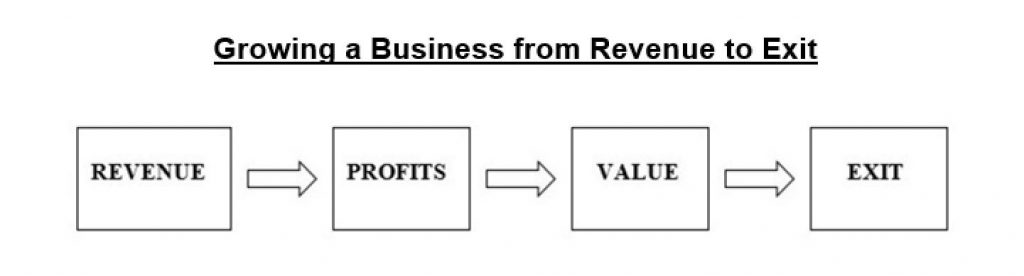

Most businesses start with an idea that is brought to market. Customers purchase the product or service and the business begins to grow. Eventually, if the company grows enough it acquires ‘value’. And it is that ‘value’ that a buyer will purchase in an exit transaction. This newsletter is written to help business owners think through this cycle of growth as they proceed towards an eventual exit. This newsletter is a guide to thinking about revenues, profit, valuation and how they will impact your eventual exit.

An Initial Business Focus on Revenue

In the first few years of a business, the business owner(s), almost always, are solely focused on attracting revenue to the new company. Simply put, revenue is the gas that keeps the engine going, without which bills cannot be paid and the enterprise cannot continue. At the beginning, the businesses’ very survival is at stake. At this stage in the business, and with the mindset of the owner, there is a myopic focus on revenue. One of the challenges that owners face is the initial transition from generating revenue to accumulating consistent profits.

The Consistent Generation of Business Profits

Once a business is successfully growing – meaning that revenue alone is no longer the daily obsession – there should be a shift in a business owner’s mindset to thinking about company profitability. At this stage owners need to consider how the revenue that the company is generating is helping to drive and shape the business profits. Their vision starts to broaden and they start to become more strategic in their thinking, seeking to attain higher-quality, more profitable revenue. So, the initial shift from revenue to profitable revenue begins to take shape as the company’s growth depends on profits to fund its increased overhead.

Moving from Consideration of Profitability to Increasing the Value of the Business

At the more advanced stages of a business, owners start to ask themselves ‘what is my business worth?’ The focus at this point in time begins to look beyond revenue and profits and starts to look at the company value. Here, an owner should be thinking about the ‘quality’ of its revenue and profits. In other words, is the revenue and profit recurring in nature or is it project-oriented and one-time in nature? Are competitors squeezing margins or are there high barriers to entry (or other factors) that help protect your margins?

These types of advanced questions indicate a focus on what a future buyer will see when they look to acquire the business. By having protected margins, consistent profits, and organized systems and people, the value of the company increases. And when owners begin to focus on these critical areas, they are only one small step away from asking the ultimate question, i.e, ‘who will own and run my business next and how will I benefit and/or get paid the value of the business?’

The Final Step, from Value to Exit

Finally, when the business owner has successfully transitioned their thinking through this entire process, they can begin to focus on their exit. At this point in time, an owner begins to consider who will pay them for the value that lies within the business. Some owners want to transfer the business to co-owners, managers or family members, while some want a buyer to pay the highest price. Whatever exit path is chosen, the owner is now thinking about how value will be extracted from the business while the business continues on into the future.

A Caveat on Advanced Planning

Ideally all business owners think about their eventual exit before they begin to build a company. Very few owners will actually succeed in doing this because new businesses are risky ventures and it is difficult to see beyond the survival phase, far enough ahead to figure out who will want to own the business next. That said, consideration of who will own your business next is always recommended, at any stage of the business.

Concluding Thoughts

It is only when the business owner can successfully bring themselves to the highest level of thinking, are they in the position to plan their exit from that business. So, how many owners of privately-held businesses will advance their thinking this far? That is the ultimate question when considering how many business owners will be successful with their exits and we hope that this newsletter provides a bit of guidance for your thinking towards a successful exit.

Owner Dependence Index™ Report

Below is a link to a 20 minute, 40 question online assessment that can assist you in determining your owner dependence score. There is no fee to take the assessment and your customized report is sent immediately to your e-mail and kept completely confidential.

Owner Dependence Index™ Report

As a business owner who may be thinking through the eventual exit from their business, this complimentary online assessment may be the ideal starting point. And, after receiving your Owner Dependence Index™ report, you may want to take a follow up meeting to discuss your answers to the questions to gain further clarity on how you may have a successful exit in the future.