Owners of privately-held businesses rarely stop to think about the long-term sustainability of their companies. More often, owners are interested in meeting their short-term and interim-term goals. However, owners should give some consideration as to how many more decades their business will continue to provide services to the marketplace. In other words, what does the long-term have in store for your company and all of the people that your business impacts? This newsletter is written to get owners to try to answer this question and also to think through the implications of not making time in their busy lives to plan for a future that is inherently uncertain but extremely important.

How Long Will Your Company Survive?

One of the most interesting questions that a business owner can ask is how long their privately-held business is going to survive. Is it 10 more years? 25 more years? 50 more years?

Of course this is a very difficult question to answer because the future can be so uncertain. In fact, most owners of privately-held businesses avoid the question all together and simply go about the business of running their companies, with little thought about what the final day of the business that you created might look like.

The Longevity of the Largest Companies

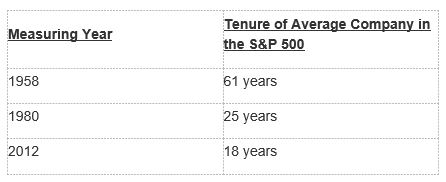

In the book, Creative Destruction, an alarming statistic is revealed about the longevity of the largest US Companies (those in the S&P500). The book provides the following data about changes in the survival of companies:

These statistics show that the average life of a company to stay in the S&P 500 has dropped from 61 years to only 18 years since 1958 – and the trend seems to be continuing lower. This statistic is even more remarkable when one stops to think that these are the largest US companies, not risky privately-held businesses. Now, the drop-off in the average life of a company in the S&P 500 does not mean that the company simply went out of business. It could have been acquired by or merged with another company. Even still, it raises an interesting question about the longevity of a privately-held business in light of the relatively short lifespan of the larger average for publicly-traded companies.

What Happens to Companies that Stop Serving their Markets

Owners often ask what happens to a business that does not continue to serve its customers. In most cases, the answer is the obvious one – the business gets absorbed by the marketplace. Or another way of putting it is that your competition wins your customers, permanently. When engaged in conversation about the future of their businesses, most owners are of the mindset that they would like to see the business continue to serve its purpose in the marketplace and not be reduced to rubble at some point in the future.

So, how can a business owner begin to answer the question of ‘how long will your company stay in business?’

Question #1: How will Your Company Survive you?

In the case of most privately-held businesses, there is a bottleneck at the top of the bottle – it resides with the owner himself. It has been said that every privately-held business is run to the level of competence (or more accurately, incompetence) of that owner. Since this is the case, it logically also means that the longevity of most of these businesses is tied to the lifespan and working ability of the founder / owner.

If you can make your business less dependent upon you, then the chances of your company surviving your demise (or at least or inability or unwillingness to work) increase dramatically. While this seems a rather obvious statement, it is shocking how many privately-held businesses do not survive their owners.

There are many business, personal and psychological reasons why companies are inexorably tied to their owners. However, the question as to whether or not your company will survive you is one of the first that must be answered to understand how long your business will continue to exist.

Question #2: How much do you care about your company surviving you?

Now, before you start a somewhat long and complex process of helping to assure that your business survives you, it is important that you first decide how much you care about your company surviving you.

Many owners care deeply about the companies that they have built. These owners are job creators, leaders in their fields and communities as well as providers for their families. The thought of a business failure is a tough one for most owners to swallow because it is a loss of so much more than a financial asset. Therefore, if you care deeply about the longevity of your business, it is helpful to know that there are specific steps that you can take to help assure that your business continues on after you are unable (or unwilling) to actively participate in the company.

Question #3: Who is Your Next Owner?

If you know that your company may or may not survive you but you’d really like to see the business continue into the future, then the next questions to answer is ‘who is most likely to own your business after you’? There are two (2) categories of owners: First are the insiders such as managers and family. Next are financial investors and competitors.

If you decide that you want your company to stay in business beyond your time at the company, it is helpful to know which owner is likely to take over your business. And the reason that this is important to know today is because you’ll want to begin preparing the company for a future transition based upon who you expect will own it in the future.

Concluding Thoughts

The answer as to ‘how long will your company will stay in business?’ is often-times directly related to the manner in which you apply yourself to answering this question as well as the actions that you take, over a period of time, to help assure its longevity. If you want your business to be around after you, begin the planning process today to help reduce the chances that your company will end when your tenure is up.

BERI™ Report

Below is a link to a 10 minute, 20 question online assessment that can assist you in determining your financial and mental readiness for your exit. There is no fee to take the assessment and your answers are sent immediately to your e-mail and kept completely confidential.

Business Exit Readiness Index™ Owner’s report As a business owner who may be thinking through the eventual exit from their business, this complimentary online assessment may be the ideal starting point. And, after receiving your Business Exit Readiness Index™ Owner’s report, you may want to take a follow up meeting to discuss your answers further and gain more clarity on how you will have a successful exit in the future.